Miss Thrifty11 September 29, 2012

Oh, don’t look at me like that: I know it’s still September, and I’m not about to go Christmas crazy on you. But let’s face it, before you know it we are all going to be drowning in everything tinselly. So I’m going to nip in here like a Jesus’ Birthday Ninja, before the festive hysteria begins gathering steam.

Oh, don’t look at me like that: I know it’s still September, and I’m not about to go Christmas crazy on you. But let’s face it, before you know it we are all going to be drowning in everything tinselly. So I’m going to nip in here like a Jesus’ Birthday Ninja, before the festive hysteria begins gathering steam.

In previous years I’ve blogged about various ways to save money at Christmas time, from homegrown Brussels sprouts to voucher codes. This year I am going to be setting out, in a series of posts, how I prepare for Christmas.

There are two points to make. Firstly, for the most part, I don’t go overboard. I know there are superhumans out there who begin planning for Christmas in March, bake their Christmas puddings in April, buy lots of presents throughout the year and start running up tree decorations on their sewing machines in the summer. I have tried, but I am not one of those people. The nearest I come to it is buying next year’s Christmas cards for next-to-nothing in the January sales. But as for the rest of the year: I’m a busy person, y’all! I have a full-time job, a family, sleep deprivation and plenty of other stuff to do. I am sure that many of you are the same. So I am not about to tell you to go out and begin stockpiling on Christmas gifts now NOW NOW. There will be plenty of time for that and besides, the best Christmas bargains have yet to come.

Secondly, I’d like to doff my Yorkshire flat cap to the offers website Discount Voucher Site, for sponsoring this post. Thanks chaps!

Now then…

Christmas is still three months away, so breathe easy: I’m not about to tell you to go out and buy anything. Instead, in this thrifty countdown to Christmas, we are going to begin with a notebook and a number.

Personal experience has taught me that the easiest way to save money at Christmas is to know your budget in advance. Once you begin stepping across the thresholds of shops, flexing the plastic online and trawling the supermarket with a whopping great food trolley, it is easy for the bill to soar if you haven’t worked out beforehand how much you have to spend in total.

So work out what your budget is going to be.

To determine your budget, take your notebook and pencil and break down your spending into the following categories:

1. Christmas Gifts

For whom will you be buying Christmas presents this year? List the recipients by name. Next to each name, write down the maximum amount you intend to spend on that person. (Leave some space on the page next to the names though. That way, when you do purchase gifts, you can log the items and prices and keep a running tally of what has been spent to date.)

2. Christmas Food

You don’t need to draw up your food shopping list just yet – unless you want to, of course. But put a figure on how much you plan to spend.

3. Other

How much do you want to spend on a Christmas tree this year? If your decorations are tatty, do you plan to buy new ones? If you will be travelling to spend Christmas with friends or relatives, have you factored in petrol? List these costs, and others, in this section.

When you have done this, add up the pounds and write down your grand total…

…I bet my bottom dollar that it’s more than you thought it would be! Planning Christmas is like planning a wedding: all those small costs tot up fast, if you don’t keep a beady eye on them.

Now you have two options:

If your budget is within the realm of possibility: excellent work! Ring-fence that money: put it by, or save it up, as soon as you can.

If your budget is racked way too high: that’s fine too. Go back through the list with an eraser and pencil, revising downwards… and downwards… and downwards… until you end up with a figure you can afford. Even if it means making a DIY Christmas tree, or dollying up your tired decorations instead of buying new ones, or cutting your gift and food budgets to the bone.

In subsequent posts, we’ll be looking at various ways to slash the costs of Christmas, from homemade gifts to cut-price groceries and bargain buys, so at this stage don’t fret too much if the budget you have ended up with looks fantastically low. That said, if your budget is worrying you and you have particular concerns, let me know and let’s see what we can do to address them.

In case you are wondering: I am buying presents for 16 people this year including my husband and son, and my total budget for gifts is £180. I haven’t yet decided how much I can get away with posting about what I buy, make and do – there are members of my family who read this blog – but I’ll be sharing as much as I can without ruining any surprises.

From Boden to Boots, and from Redletter to Virgin: DiscountVoucherSite.com is the discount offers and voucher codes website for shoppers who seek the best bargains, every time.

From Boden to Boots, and from Redletter to Virgin: DiscountVoucherSite.com is the discount offers and voucher codes website for shoppers who seek the best bargains, every time.

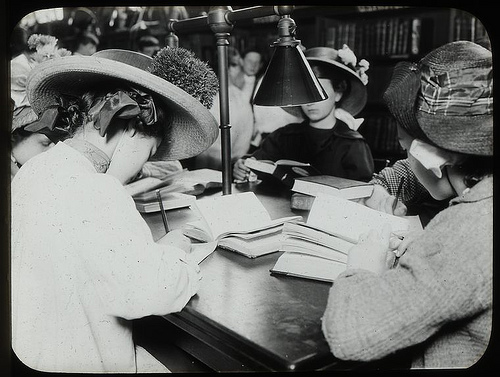

Image credits: George Eastman House, New York Public Library.

11 Responses to “Save Money at Christmas, Part One: The Magic Number”

Julie at Nutmeg says:

Good tips! I look forward to reading more as Christmas approaches!

October 1, 2012 at 1:00 pm

Carlos Hank Rhon says:

Once you begin stepping across the thresholds of shops, flexing the plastic online and trawling the supermarket with a whopping great food trolley, it is easy for the bill to soar if you haven’t worked out beforehand how much you have to spend

October 2, 2012 at 7:55 pm

Eviee says:

Great tips! I look forward to learning more about saving around christmas time! For some reason around christmas my budgeting goes out the window, I spent way to much and I losse all my savings! I definately need a plan this year!

October 3, 2012 at 3:51 am

Casey says:

I’ve found that Christmas Trees are a huge additional and unnecessary cost at Christmas time, buying a good quality fake tree is a great investment. Although it is a big up front cost, a quality tree with save you money in the long run as they can last for 10 or more years.

October 4, 2012 at 4:14 am

15522188 says:

Each and every Boxing Day when the stress of Christmas day has been and gone, my mother exudes a sigh of relief and vows never to leave the stresses of Christmas until the last possible moment again. However, each Christmas seems to come around quicker than you know and it feels like Groundhog Day once again. This blog was great, you clearly laid out simple ways to save money for all busy parents who have in the past succumbed to the stress through indulging in their credit card. These are tips that I will undoubtedly be guiding my mother through in the lead up to this Christmas.

October 4, 2012 at 8:33 am

Working Girl says:

I’ve already started on my shopping 🙂 And I set a budget, much like I did last year but with a reduced budget. Luckily I don’t have many people to buy for and this year I’ve plumped for getting people a few small gifts (in a £1 gift bag each) rather than one or two larger gifts. And I’ve tried to get everyone something along the lines of something toiletry-wise, something fun, something practical, something sweet and a scratchcard (or least I’ll get them when the xmas themed ones appear at work). Hopefully they’ll like what they get!

October 4, 2012 at 9:20 pm

Patti says:

Great idea about actually writing it all down and something I will definitely do this year. I’m also knitting some small gifts. My downfall is the supermarket so I can’t wait to read your tips on this. I’ve just discovered we have Aldi here in New Jersey so I’m hoping they will help my budget. And I do agree about an artificial tree even though you don’t have the wonderful tree smell you also don’t have needles all over the house and pets drinking out of the tree holder so it also saves on cleaning time. Since we celebrate Hannakah and Christmas I need all the budgeting help I can get.

October 6, 2012 at 12:58 pm

Miss Thrifty says:

Thanks all for your comments. It looks like this post has touched a nerve, which is a relief, because I was acutely conscious when writing it that Christmas is still a wee way away…!

October 6, 2012 at 3:12 pm

yujiao-joannasui says:

That’s the good & great ideas! To determine your budget, take your notebook and pencil and break down your spending into the following categories. Although your blog talk about the Save Money at Christmas, but i think your ideas it’s also to suit other things on save money…i like your ideas and also thanks to you share yours ideas. I will use your ideas entry my daily life. Thank you again help me save mony…

November 15, 2012 at 11:10 am

Neil says:

You can save money if you can have an earlier shopping as the value of gift items are even cheaper and still you have the choice. Do not wait for its last minute release if you can avail a fast cash like short term loans uk.

December 15, 2012 at 7:03 am